Strengthen Your Roofing Business with Efficient Bookkeeping Services in San Antonio, TX

Optimize Your Roofing Company's Finances with Professional Bookkeeping Services in San Antonio, TX

If you own a roofing company in San Antonio, TX, you know how demanding and fast-paced the industry can be. Amidst managing projects, coordinating teams, and delivering quality services, paying attention to your business's financial aspect is crucial. Efficient bookkeeping services can provide immense value to roofing businesses like yours in San Antonio, ensuring accurate financial management and driving growth.

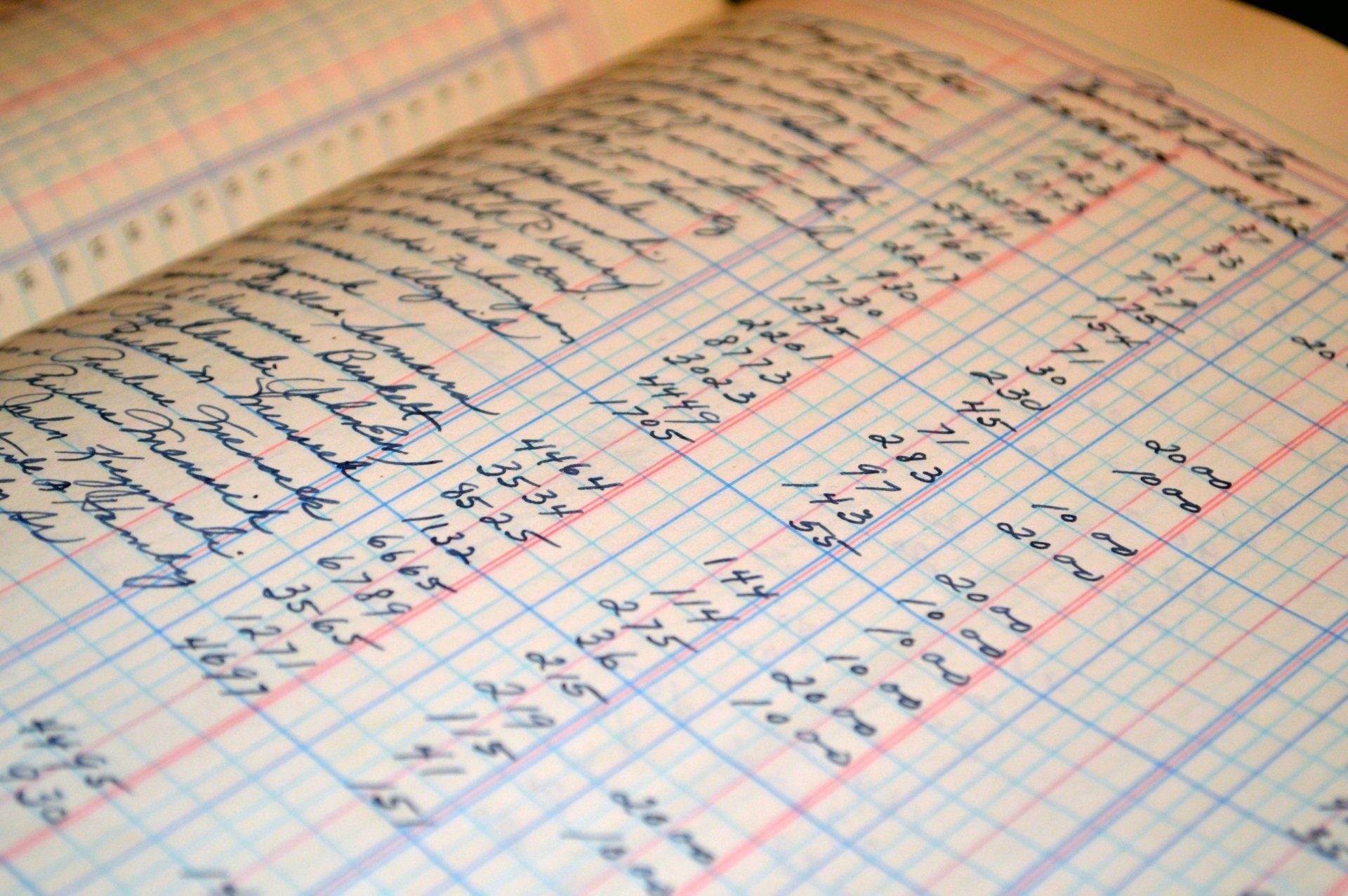

Precise Financial Record-Keeping

As a roofing company, you handle various financial transactions daily, including materials purchases, equipment maintenance, and payroll. Trying to keep track of these activities manually can be time-consuming and prone to errors. By utilizing professional bookkeeping services, you can ensure precise financial record-keeping. This allows you to clearly understand your company's financial health, make informed decisions, and maintain control over your finances.

Streamlined Invoicing and Expense Tracking

Roofing projects often involve multiple expenses, such as labor costs, equipment rentals, and subcontractor payments. Bookkeeping services can streamline your invoicing process, ensuring accurate and timely client billing. Moreover, they help you track expenses effectively, enabling you to identify cost-saving opportunities and optimize your profitability.

Timely Financial Reports and Analysis

Gaining insights into your roofing company's financial performance is essential for making informed business decisions. Professional bookkeepers can provide regular financial reports summarizing your income, expenses, and cash flow. These reports allow you to analyze your economic trends, identify areas for improvement, and make strategic adjustments to enhance your business's overall performance.

Hassle-Free Tax Compliance

Tax compliance is a critical aspect of running any business. Navigating complex tax regulations and deadlines can be overwhelming, particularly for roofing companies focused on delivering quality services. By entrusting your bookkeeping to professionals, you can ensure that your roofing business complies with tax requirements. They will help you stay organized, minimize errors, and maximize eligible deductions, ultimately reducing your tax liability.

Focus on Core Business Functions

Outsourcing your bookkeeping tasks to experts frees up valuable time and resources, allowing you to focus on core business activities. By offloading your bookkeeping responsibilities, you can concentrate on managing roofing projects, improving customer relationships, and expanding your business. This way, you can maximize your productivity and stay ahead of the competition.

In conclusion, professional bookkeeping services are crucial in strengthening your roofing business in San Antonio, TX. From precise financial record-keeping and streamlined invoicing to timely financial reports and tax compliance, bookkeepers can optimize your company's financial management. By outsourcing this essential function, you can devote more time and energy to growing your roofing business and achieving long-term success.

Remember, effective financial management is the key to a thriving roofing company. Embrace the benefits of professional bookkeeping services and unlock the true potential of your business.

Get a Free Consultation

Accurate, weekly bookkeeping tailored to small business owners—so you can grow with confidence.

Latest Posts