Cash Flow vs Profit: What's the Difference

Learn how to manage cash and track profit the right way — and why confusing the two can cost your business big time.

You’re running a business and see a healthy profit on paper — yet your bank account feels empty. Sound familiar?

This happens because profit doesn’t equal cash flow. Confusing the two can cripple your decision-making and growth plans.

💵 What Is Profit?

- Profit = Revenue – Expenses

- It’s your bottom line — what’s left after covering costs.

Types of Profit:

- Gross profit: Sales – Cost of Goods Sold

- Net profit: What’s left after all expenses (rent, payroll, marketing, etc.)

💧 What Is Cash Flow?

Cash flow tracks the real-time movement of cash in and out of your business.

Types of Cash Flow:

- Operating cash flow: From day-to-day activities

- Investing cash flow: From asset purchases/sales

- Financing cash flow: From loans or investor funding

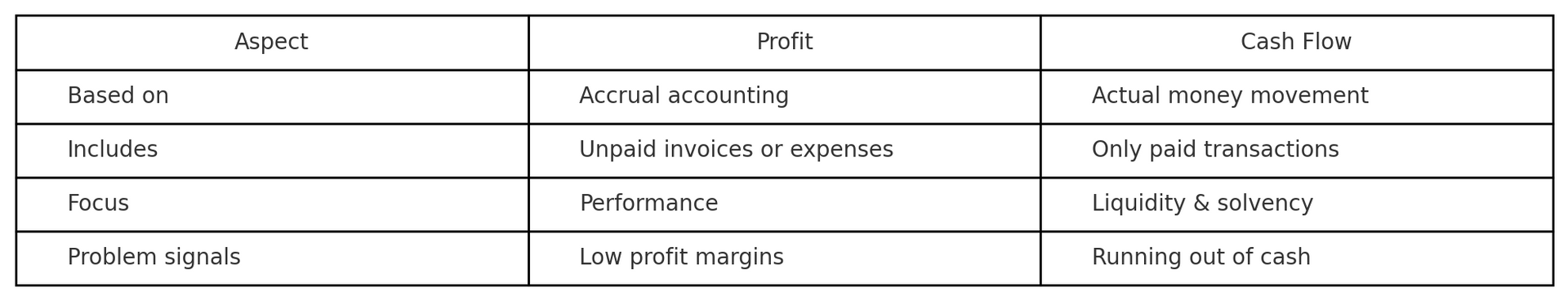

🔍 Key Differences Table

🚨 Why the Confusion Is Dangerous

- You might be “profitable” but unable to pay bills.

- You could miss payroll or default on loans.

- Growth becomes risky without knowing your runway.

📈 How to Improve Cash Flow

- Shorten payment terms for clients.

- Delay large purchases until cash allows.

- Keep a 3-month buffer for operating costs.

- Use tools like Float or Pulse for cash flow forecasting.

🎯 How to Track Both Effectively

- Utilize bookkeeping software to generate P&L and cash flow reports every month.

- Compare projections with actual cash on hand.

- Always plan for cash — not just profit.

Understanding the difference between cash flow and profit is more than a technical detail — it’s a survival skill for small business owners. Profit might look good on paper, but cash flow is what keeps the lights on. Stay on top of both by reviewing your reports regularly, planning, and maintaining a cash buffer. With clarity and good cash management habits, you’ll be in a better position to grow sustainably and avoid financial surprises.

Get a Free Consultation

Accurate, weekly bookkeeping tailored to small business owners—so you can grow with confidence.

Latest Posts